Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

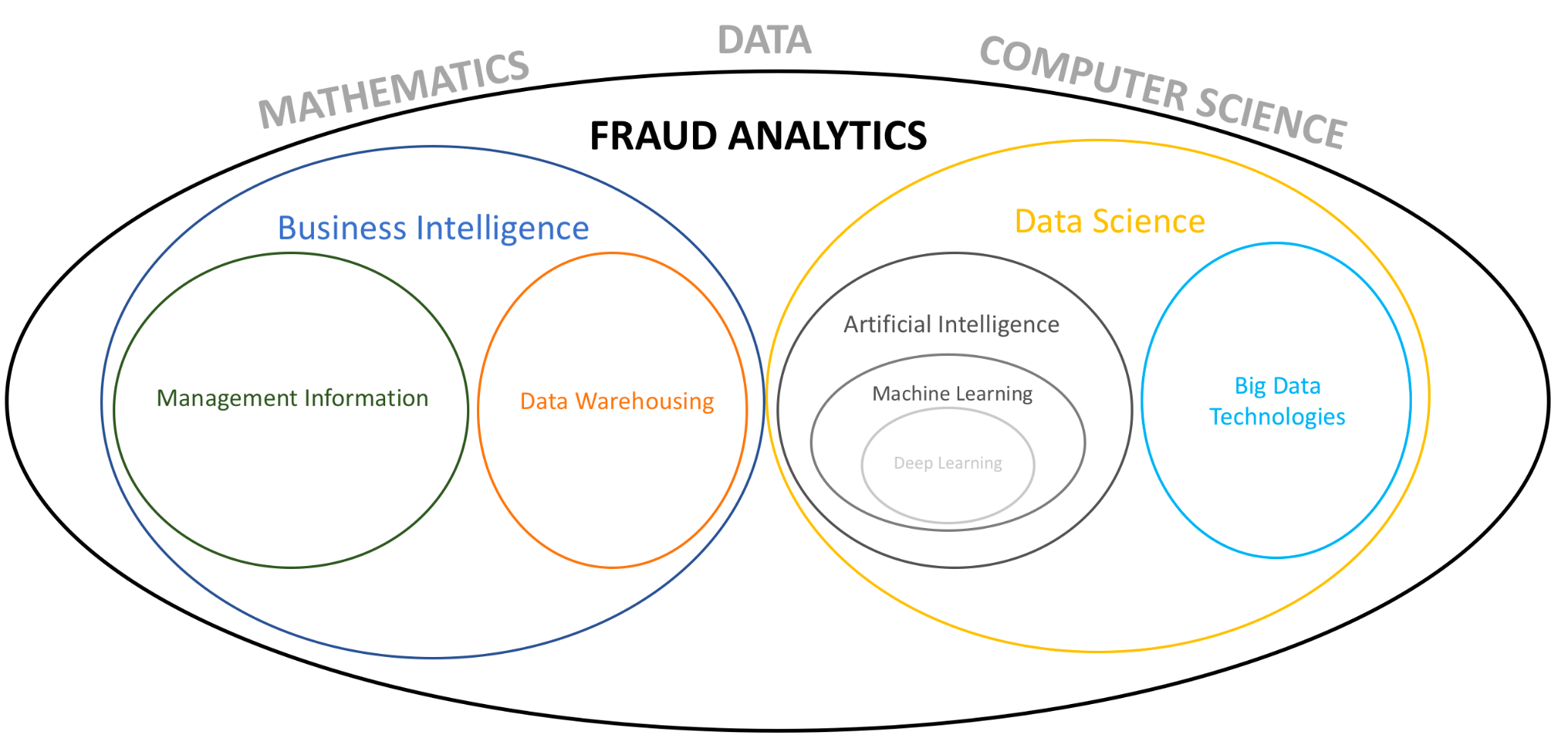

SAMA’s counter-fraud framework emphasizes the critical role of technology and analytics in detecting, preventing, and responding to fraudulent activities. Modern fraud schemes have become increasingly sophisticated, requiring banks to implement advanced technological solutions and analytical capabilities.

SAMA mandates the implementation of sophisticated real-time monitoring systems capable of analyzing transactions across multiple channels. These systems must process vast amounts of data to identify suspicious patterns and potential fraud indicators as they occur. The monitoring infrastructure should cover all customer touchpoints, from traditional banking channels to digital platforms.

Financial institutions must deploy comprehensive analytics platforms that combine multiple analytical approaches. This includes predictive modeling, machine learning algorithms, and behavioral analytics to detect anomalies and emerging fraud patterns. The platform should be capable of adapting to new fraud schemes and continuously improving its detection capabilities through learning mechanisms.

SAMA expects banks to maintain a unified data architecture that integrates information from various sources. This includes transaction data, customer information, external fraud databases, and third-party information sources. The architecture must support real-time data processing while ensuring data quality and consistency.

Strong data quality management processes are essential for effective fraud detection. Banks must implement robust data validation mechanisms, regular data quality assessments, and automated data cleansing procedures. This ensures that analytics systems operate with accurate and reliable information.

The framework requires sophisticated pattern recognition capabilities to identify:

Banks must implement advanced behavioral analytics systems that can:

The technology infrastructure must be scalable to handle increasing transaction volumes and growing analytical requirements. This includes cloud-based solutions where appropriate, ensuring compliance with SAMA’s data residency requirements.

Counter-fraud systems must integrate seamlessly with:

Banks must maintain comprehensive dashboarding capabilities that provide:

The framework requires sophisticated alert management systems featuring:

SAMA emphasizes the importance of AI and ML capabilities for:

Implementation of modern authentication technologies including:

Banks must implement systems for:

SAMA’s technology and analytics requirements for counter-fraud frameworks demand sophisticated solutions that combine advanced technology with robust analytical capabilities. Success requires continuous investment in technology infrastructure while maintaining flexibility to address emerging fraud threat.